On Thursday, a major decision favoring government staff was made in anticipation of the next general budget.

During a cabinet meeting chaired by Prime Minister Narendra Modi, establishing the Eighth Pay Commission received governmental approval.

This initiative will benefit 4.5 million central government workers and 6.5 million pension recipients, amounting to 11.5 million people.

The Seventh Pay Commission’s tenure will come to an end on December 31, 2025, and the new Eighth Pay Commission will commence on January 1, 2026.

Ashwini Vaishnav, the Minister of Information and Broadcasting, shared that there will be efforts to ensure that the new Pay Commission’s suggestions are finalized before the conclusion of the Seventh Pay Commission’s term.

Since the country achieved independence in 1947, seven pay commissions have been formed.

Many state governments follow this framework as well. Therefore, approximately 14 million workers (not including pensioners) across 29 states will also gain from this program.

The prior commission created a financial strain of ₹1 lakh crore on the government due to wages and pensions. On the other hand,

it is estimated that the new pay commission will contribute ₹2 lakh crore to the economy.

Vaishnav indicated that appointments for a chairman and two members of the new pay commission would be made shortly.

The upcoming 8th Pay Commission is expected to bring significant changes to the pay, benefits, and pensions of government employees in India. Here’s a breakdown of what could change,

- Minimum Wage Increase

The minimum wage is projected to rise from ₹18,000 (under the 7th Pay Commission) to ₹46,000. This represents a significant boost in earnings for lower-level employees. Additionally, gratuity (a one-time payment made to employees upon retirement) will also increase by roughly 2.5 times.

- Highest Salary Increase

For top-level government officers like secretaries, the current basic salary is ₹2.5 lakh per month under the 7th Pay Commission (excluding allowances like dearness allowance). With the proposed fitment factor of 2.57, this salary is expected to increase to ₹6.4 lakh per month in the 8th Pay Commission.

- Gratuity

Gratuity is currently capped at ₹30 lakh. Unless the government raises this limit, the maximum amount an employee can receive will remain unchanged. If revised in line with salary increases, this cap may also rise.

- Home Loan Benefits

Central employees are eligible for home loans linked to their basic salary. In the 6th Pay Commission, this loan was capped at ₹7.5 lakh. Under the 7th Pay Commission, it increased 3.2 times to ₹25 lakh. With the 8th Pay Commission, this amount is likely to rise to ₹80 lakh, providing employees with significantly better housing benefits at low-interest rates (approximately 8.5%).

- Pension Changes

Pensions are also expected to see a major boost. Here’s how it may work:

- In past pay commissions: Pensions rose by 14% in the 6th Pay Commission and by 23.66% in the 7th Pay Commission.

- Anticipated increase: With the trend of larger increments, pensions are likely to increase by at least 34% under the 8th Pay Commission.

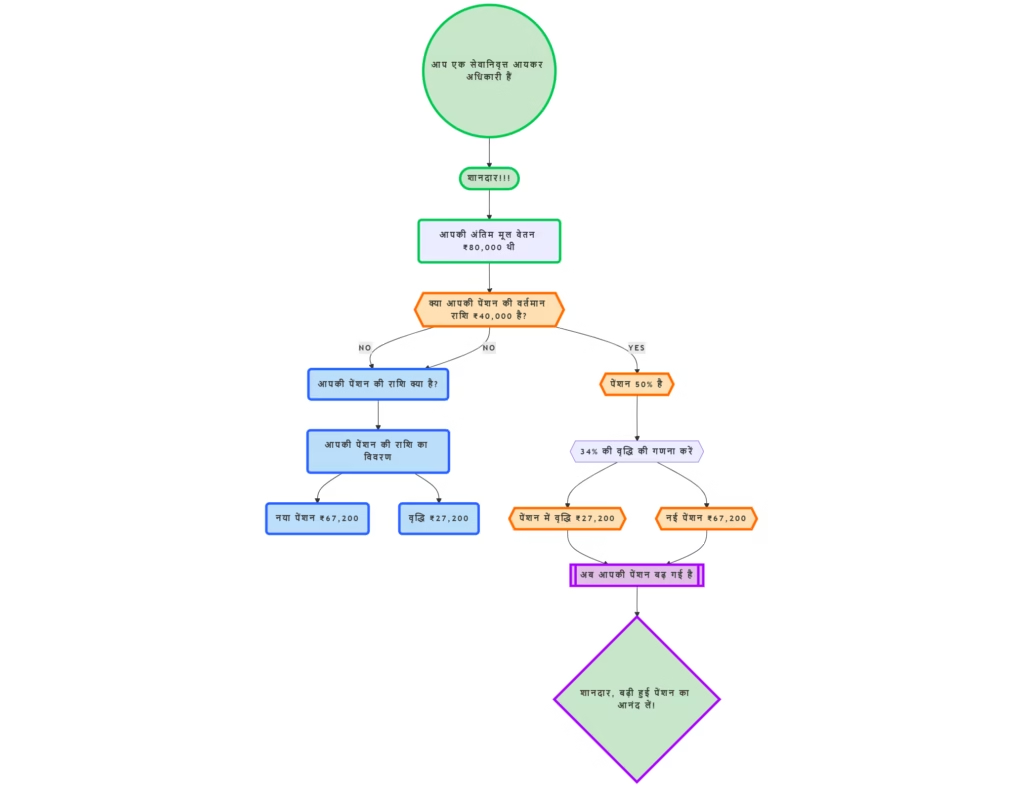

Example 1:

A retired Income Tax Officer with a final basic salary of ₹80,000 currently receives a pension of ₹40,000 (50% of the last basic). With a 34% increase, their pension would rise by ₹27,200, resulting in a new pension of ₹67,200.

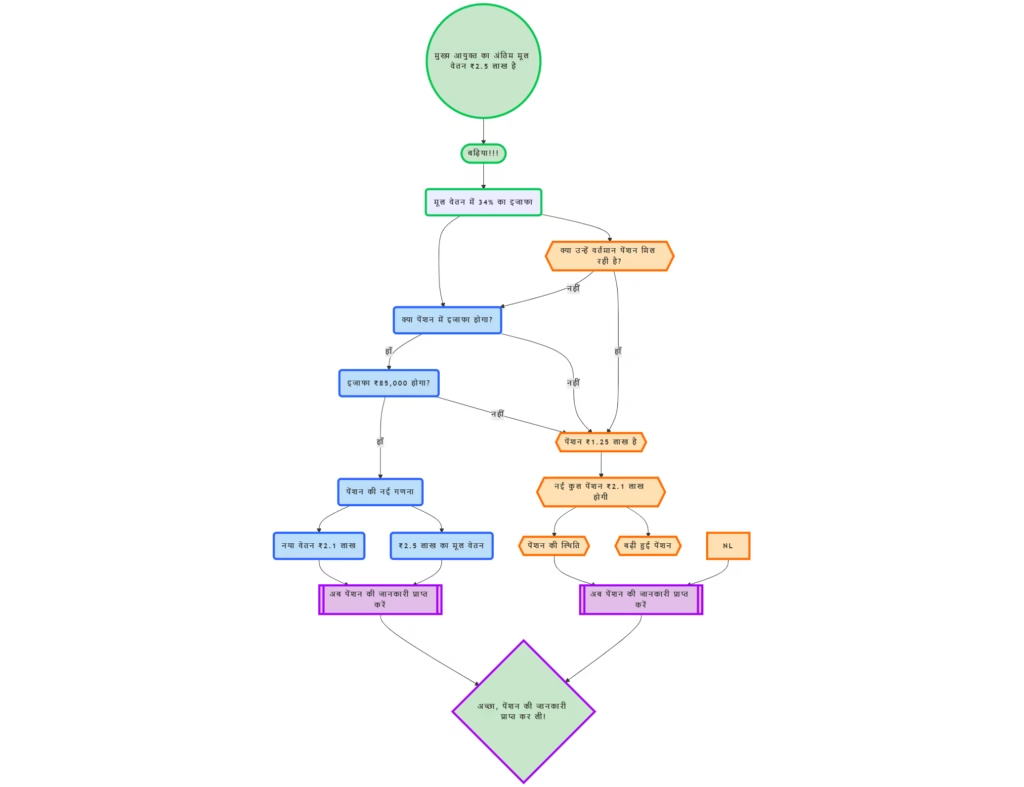

Example 2:

A Chief Commissioner with a last basic salary of ₹2.5 lakh currently gets a pension of ₹1.25 lakh. With a 34% increase in basic, their pension would rise by ₹85,000, resulting in a new total of ₹2.1 lakh.