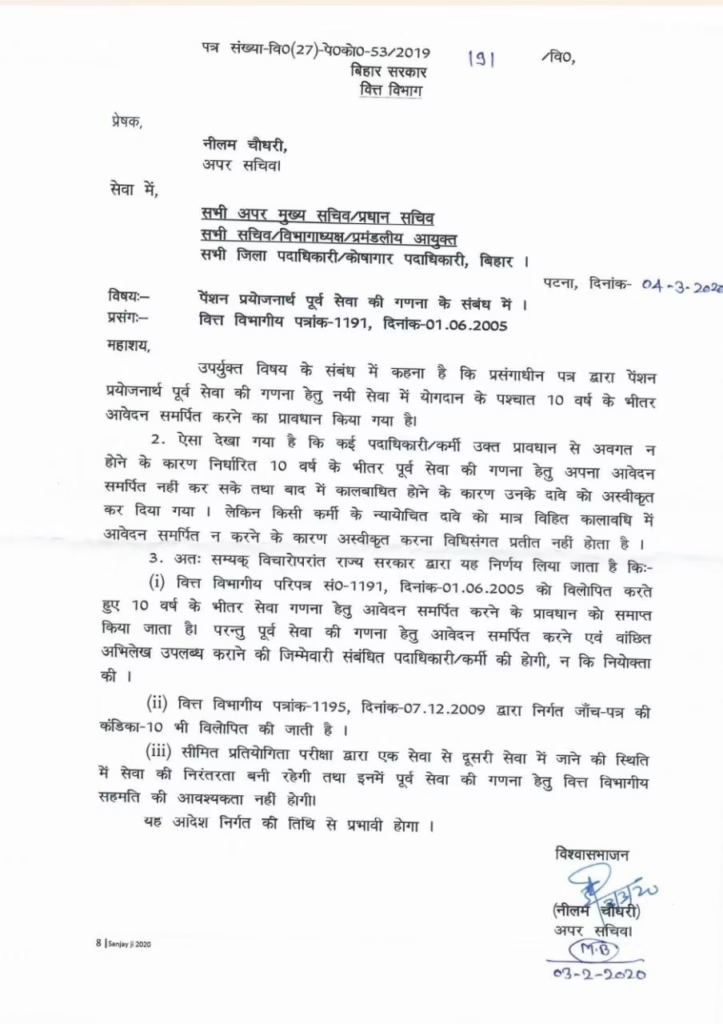

Pension is a major means of financial security for government employees after retirement. To implement this system properly, the government provides guidelines from time to time. On March 10, 2025 the Finance Department of Bihar Government has recently issued an important letter, in which the necessary conditions related to the calculation of previous service have been clarified. The names of the parties and the dates (such as 01.06.2005 and 07.12.2009) in the letter indicate its long-term legal process.

Evaluation of previous service for pension

Under the pension scheme, it is extremely important to properly assess the tenure of a government employee. If the previous tenure of an employee is not evaluated, it can have a negative impact on their pension. The Bihar government has clarified in its recent directive that for assessment of previous service, the employee is required to apply within 10 years. After a period of more than 10 years, the previous service of the employee will not be valid.

New instructions by the Finance Department of Bihar Government

The following important facts have been clarified in the note issued by the Finance Department of the Bihar Government:

1. Compliance of duration is mandatory

- The application for assessment of previous service will be accepted only within 10 years.

- Applications made after the completion of 10 years will be rejected.

2. Guidelines for re-appointed employees

- If a government employee returns to service again, he must apply on time for calculation of his previous tenure.

3. Appointment and confirmation of service record

- The bulletins issued by the Finance Department have given clear guidelines for evaluating previous service.

- Under Bulletin No. 1195, dated 07.12.2009, ‘Clause 10’ has also been used.

Process to apply for calculation of past service

If you are working in any department of Bihar Government and want to calculate your past service, then you need to follow the following steps:

1. Contact the concerned department

- Contact the finance branch or pension section of your department.

2. Collect the required documents

- A copy of the appointment letter

- Service details certificate

- Application form for pension

- Other required documents

3. Apply on time

- Make sure that your application is submitted to the finance department within 10 years.

4. Checking and verification of documents

- All submitted documents will be checked and verified if required.

Government’s new decisions and their consequences

The state government has clarified that if an employee does not apply on time for calculation of his old service, then the responsibility will be entirely on that employee, not on the employment authority.

Additionally, if an employee moves from one service to another through limited competitive examination, then he will not need the approval of the Finance Department to calculate the previous service.

This decision will be beneficial for those employees who are transferred to different departments or join new service through limited competitive examination. This will make their pension process easier and they will not have to suffer financial loss.

Key Points and Analysis

Let us take a closer look at the key elements of this report:

1. Administrative Directions

This document mentions that the Judge-in-Charge recognised the contribution of Neelam service for calculation of service and accepted it on the basis of 10 years. This appears to be a straightforward case of recognition of tenure of an employee. Usually, this happens when there is some discrepancy or delay in calculation of tenure of an employee, which leads to conflict of interest. This decision has been taken in the benefit of the employee, which is a necessary step under the Indian Administrative Service Rules.

2. Legal Process

This document also mentions that the concerned District Court/Court took cognizance of the matter and recognised 10 years of service. This shows that the matter was pending for a long time and was reviewed at various stages. This often happens when the case is complex or there are differences between the parties. The judgment given in favour of the employee also makes it clear that the Court decided on the basis of sufficient evidence and reasoning.

3. Fixation of pay and allowances

This document also mentions that the pay and allowances will be calculated by the concerned authorities. This is an important point, as it ensures that the employee gets a fair financial reward for his service. This process is based on the principles of transparency and fairness, which is the basic foundation of the Indian administrative system.

Process and problems

The legal process has many hurdles, especially when a case drags on for years. The article also references the period between 2005 and 2009, which shows that the process can take time. There can be many reasons for this, such as:

- Missing or incorrect documents, causing the case to resurface.

- Failure to reach a consensus between the parties.

- Delays due to a backlog of cases in the court.

However, this judgment has overcome these hurdles and brought a positive outcome. It is also a lesson that with patience and proper legal guidance, these difficulties can be resolved.